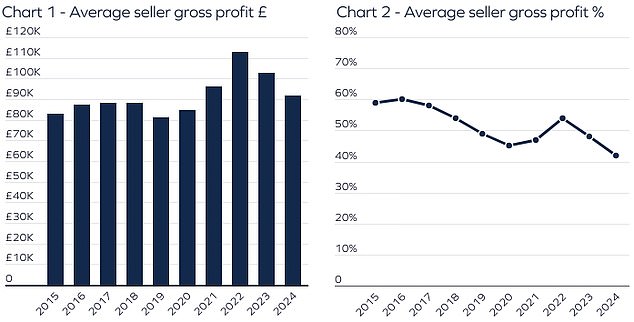

The amount of money sellers make from their homes is shrinking, according to new data analysis by estate agent Hamptons.

Last year, the average homeowner in England and Wales sold their home for £91,820 more than they paid for it, having owned it for 8.9 years on average.

This figure has fallen by £10,830 since 2023 and is down from a peak of £112,930 in 2022.

Despite lower price gains last year, 91 per cent still sold their home for more than they paid.

In percentage terms, returns from property have fallen to the lowest level since at least 2015, when Hamptons’ records began.

Last year, the average seller in England and Wales sold their home for 42 per cent more than they paid, down from a 48 per cent increase in 2023.

Smaller gains: The average difference between sale and purchase price in England & Wales has reduced in recent years

Property gains peaked in 2016 when the average home sold for 60 per cent more than its purchase price.

Most of these 2016 sellers bought just after the financial crash, from which house prices generally recovered quickly, particularly in the South of England.

‘These proceeds typically fuel moves up the property ladder,’ said Aneisha Beveridge, head of research at Hamptons.

‘However, smaller and slower equity gains over recent years, particularly for flat owners, has made this more challenging.

‘On top of this, households have had to grapple with higher mortgage and transaction costs, such as stamp duty, making it more costly to move.’

London homeowners see biggest falls

While sellers in every UK region saw their returns fall between 2023 and 2024, Londoners were among the worst impacted.

The average 2024 seller in London saw the value of their property rise by £172,350 since they bought it, £31,840 less than those who sold in 2023.

This marked the first time that property gains in the capital have fallen below £200,000 since at least 2015.

In percentage terms, the average London home sold for 44 per cent more than its purchase price, a figure that has been declining since peaking at 100 per cent in 2016.

This is hardly surprising given how stagnant London property prices have been since 2016.

Most of the gains made by Londoners were made in the years immediately following the 2008 crash.

Making less: London sellers saw their average gain fall below £200,000 for the first time. They’re now equally as likely to sell for a loss as sellers in the North East

Between April 2009 and July 2016, the average property in London rose in value by 94 per cent from £245,000 to £475,000, based on Land Registry data.

However, since then the average London property has only increased by 9 per cent to £519,000 as of November 2024. Flats and maisonettes in the capital have only risen 3 per cent on average during that time.

Beveridge said: ‘In London, the issue is particularly acute, with property values in some areas remaining below 2016 levels, discouraging moves.

‘Only a quarter of 2024 London sellers had bought within the last five years, compared to more than a third nationwide.

‘Until property prices recover, or transaction and mortgage costs decrease, homeowners are likely to stay put for longer.

‘Usually, homeowners need to inject thousands of pounds from their own pocket to make a move financially viable, which often scuppers many potential sales.’

Average seller gain by length of ownership: Given that property prices have risen over the long term, those who have owned their homes the longest typically made bigger profits

Welsh sellers make biggest gross gains

Hamptons says that returns are now becoming more evenly distributed across the regions.

Back in 2016, 29 per cent of homes that sold for over £100,000 more than the purchase price were in London, a figure that fell to 18 per cent in 2024.

Meanwhile, the share of homes making six-figure gains that were located in the Midlands and North of England has risen from 17 per cent in 2016 to 29 per cent in 2024.

In percentage terms, for the third consecutive year, house sellers in Wales made the biggest gross gains, with the average home selling in 2024 for 48 per cent more than the purchase price.

Merthyr Tydfil replaced Barking and Dagenham as the local authority where sellers made the biggest percentage gains nationally in 2024.

Here, the average seller in 2024 received 68 per cent more for their home than they paid.

Just two London Boroughs – Barking & Dagenham and Waltham Forest – featured in the top 10 list in 2024, compared to all 10 located in the capital in 2020, 2019 and 2018.

Londoners are now equally as likely to make a loss as those selling a property in the North East.

In 2024, 14 per cent of London sellers sold their property for less than they originally paid, the same share as in the North East.

Back in 2016, just 2 per cent of London sellers sold at a loss, compared to 32 per cent in the North East.

Most of the Londoners who sold at a loss in 2024 were selling properties in inner London, having bought within the last nine years.

Those selling in Tower Hamlets were most likely to sell their property for less than they paid, with 28 per cent doing so, despite the average seller in the area making a £77,960 gross gain.

Houses do better than flats

House sellers saw more than double the gains recorded by those selling a flat last year.

The average house sold in 2024 for 47 per cent more than its purchase price, having been owned for 9 years on average.

Meanwhile, the average flat sold for 23 per cent more, having been bought 8.8 years ago.

‘Slower price growth for flats since the pandemic means that house sellers saw more price growth over the last five years than flat sellers saw in the last 10 years,’ added Beveridge.

‘The typical house seller who sold in 2024, having bought five years ago, made a gross gain of 31 per cent, compared to a 30 per cent gain for the typical flat seller who bought 10 years ago.

‘This weaker equity growth has limited flat owners’ ability to move. Just 32 per cent of flat owners who sold in 2024 moved within five years, compared to 40 per cent who sold in 2019 having owned that property for the same time.’

House sellers saw more than double the gains recorded by those selling a flat last year

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

Source link