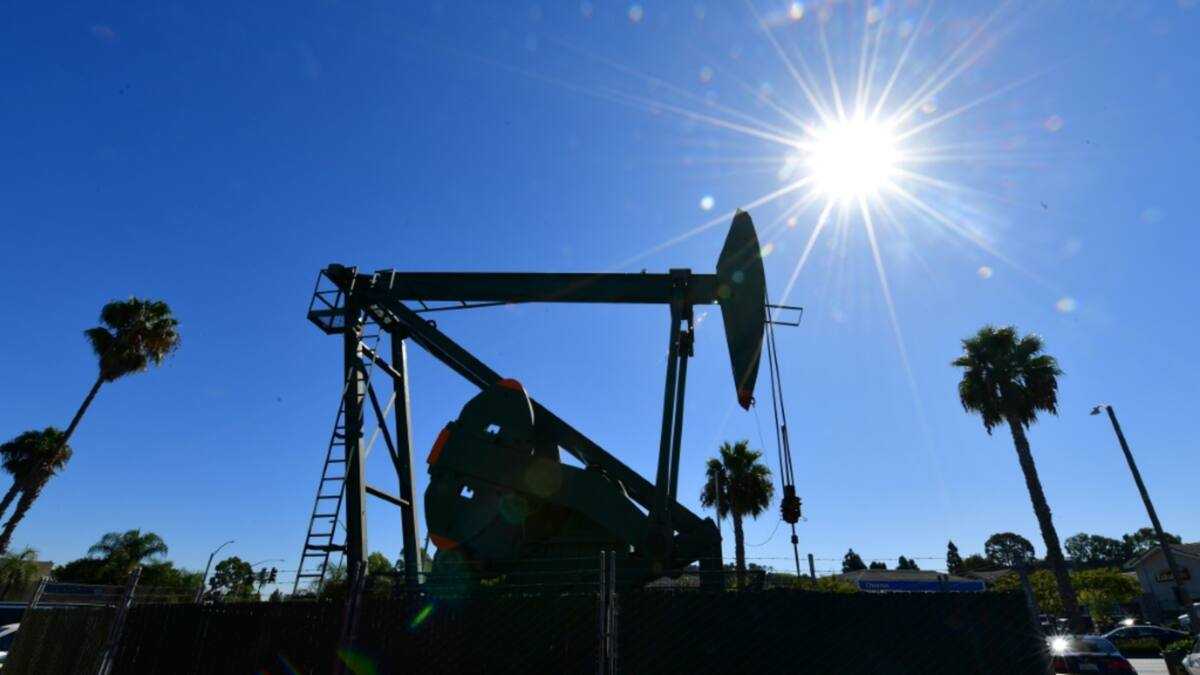

Photo: Frederic J. BROWN / AFP

Source: AFP

Oil prices rose more than one percent Wednesday, extending the previous day’s rally, and safe haven gold pushed towards a record high after Iran’s missile attack on Israel ramped up fears about an escalation in the Middle East.

News of the launch rattled US and European traders and sparked a sell-off on most markets, though Asia fared slightly better, with Hong Kong resuming its China stimulus-fuelled rally as it reopened after a one-day break.

Both main crude contracts jumped more than five percent at one point Tuesday after Iran fired dozens of missiles at Israel in response to the killings of Tehran-backed militant leaders.

While most were intercepted by air defences before reaching Israel, the move sparked a stern response from Tel Aviv and the United States, with Washington saying it was discussing a joint response and warning of “severe consequences”.

Israel vowed it would make Iran “pay” for the launch, while Tehran threatened to hit all Israeli infrastructure if attacked.

“The burning question is whether Iran’s missile strike is a one-off response or the start of something much bigger. Most bets lean towards the former, especially with the US stepping in to back Israel,” said independent analyst Stephen Innes.

“Iran’s oil infrastructure could very well be in their crosshairs. And let’s be real—taking a swing at Iran’s oil lifeline could have far-reaching economic consequences, sparking a severe escalation,” Innes wrote in his The Dark Side Of The Boom newsletter.

Demand for gold — considered a go-to in times of uncertainty and turmoil — pushed the precious metal close to its $2,685 record.

All three main indexes on Wall Street ended in the red, with the Nasdaq down more than one percent.

But Asia fared better.

Hong Kong soared more than four percent — passing 22,000 points for the first time since February last year — as traders get back to buying up beaten-down stocks after China last week began unveiling a raft of economic stimulus measures.

The Hang Seng Index has rocketed more than 20 percent over the past seven trading sessions on optimism that Beijing will press on with its stimulus campaign.

Markets were closed in Shanghai and Shenzhen for a week-long holiday, having also zoomed higher before the break.

There were also gains in Sydney, Singapore and Wellington, though Seoul, Wellington and Jakarta slipped.

Tokyo fell more than one percent, continuing its volatile run after tanking Monday on a strong yen in reaction to Shigeru Ishiba’s election as head of Japan’s ruling party.

Ishiba, sworn in as prime minister Tuesday, has said he backs the central bank’s interest rate hikes and was also eyeing possible corporate tax increases.

Dealers are also awaiting the release of key US jobs data at the end of the week, hoping for a fresh idea about the state of the economy and the Federal Reserve’s plans for borrowing costs after last month’s bumper cut.

Key figures around 0240 GMT

West Texas Intermediate: UP 1.7 percent at $70.98 per barrel

Brent North Sea Crude: UP 1.5 percent at $74.63 per barrel

Hong Kong – Hang Seng Index: UP 4.7 percent at 22,124.71

Tokyo – Nikkei 225: DOWN 1.7 percent at 38,013.76 (break)

Shanghai – Composite: Closed for a holiday

Euro/dollar: UP at $1.1071 from $1.1067 on Tuesday

Pound/dollar: UP at $1.3292 from $1.3279

Euro/pound: DOWN at 83.30 pence from 83.34 pence

Dollar/yen: UP at 143.96 yen from 143.57 yen

New York – Dow: DOWN 0.4 percent at 42,156.97 (close)

London – FTSE 100: UP 0.5 percent at 8,276.85 (close)

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: AFP