Average rents fell in the last three months of 2024 for the first time since 2019, as cash-strapped tenants stay put to avoid the expense of moving.

Typical advertised rents outside of London dropped 0.2 per cent to £1,341 per month – a fall of £3, according to Rightmove.

While only a nominal sum, it represents the first time rents have reduced on a quarterly basis since before the pandemic.

In July to September 2023 when rent rises were at their peak, the amount tenants were asked to pay increased by 3.8 per cent in that three-month period.

Before now, rents had hit a new record high for 19 consecutive quarters.

Compared to a year earlier, rents are 4.7 per cent higher – but this is the slowest rate of growth since 2021.

Rightmove described it as a ‘key milestone for the market’. At one point in 2022, rents were increasing by 12 per cent year-on-year.

Within London, rents have increased in the last quarter but only by 0.1 per cent, reaching £2,695.

Alex Bloxham, partner and head of residential lettings at estate agent Bidwells, said: ‘We’re seeing a cooling of what has been a ferociously hot rental market over the last year, where tenants have endured intense competition and consistent rental inflation.’

The quarterly increase figure hit a recent high in July to September 2023, when the amount tenants were asked to pay increased by 3.8 per cent in that three-month period alone.

Why aren’t rents going up as much?

More tenants are opting to stay in their existing rented homes rather than looking to move, according to the property portal.

This may be because they fear higher rents on a new tenancy than on the one they are currently in.

Bloxham added: ‘These figures suggest landlords are continuing to invest in their buy-to-let portfolios while more tenants are choosing to stay put, likely due to continued macroeconomic uncertainty and the upfront costs involved in relocating.’

The number of prospective tenants looking to move has also dropped by 16 per cent compared to this time last year, it said.

Rightmove also said supply in the rental market continues to increase, with the number of properties to let now 13 per cent higher than at the same time last year.

This can make rents rise less quickly, because there is less competition for each available home.

In addition, a higher number of tenants may have been able to get on the property ladder, helped by more stable mortgage rates and higher average wages.

John Baybut, managing director at Berkeley Shaw Real Estate in Liverpool, said: ‘We’ve seen a levelling off in demand from tenants, due to many factors including the end of the post-pandemic surge for new rental requirements, and some demand heading to the sales market.’

‘Tenants are paying very high rents, so with more supply on the market now, some are being more “choosey”‘.

Where have rents reduced the most?

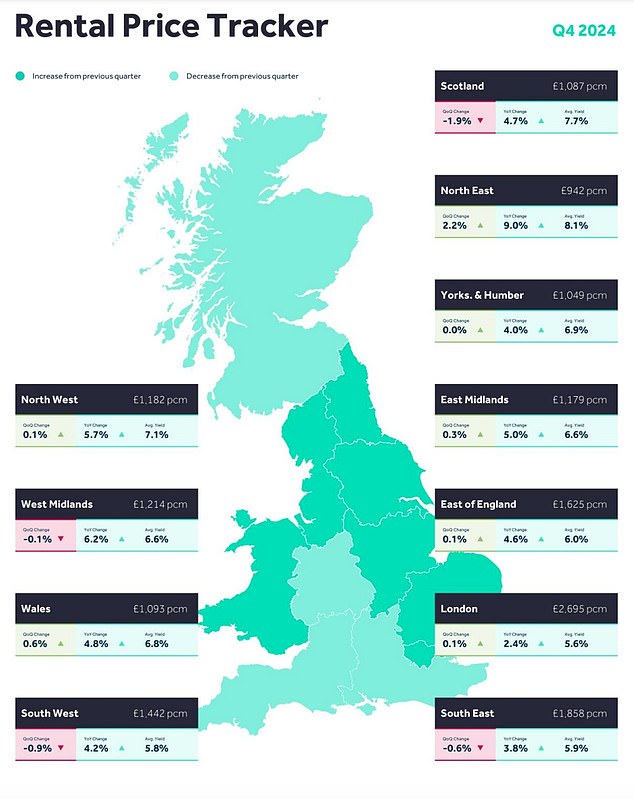

Location, location: Tenants in some parts of the country will seen bigger rent rises than others

Tenants in Scotland have enjoyed the biggest fall in asking rents in the last three months of last year, with a reduction of 1.9 per cent.

Those in the South West of England also saw a significant reduction, at 0.9 per cent, while renters in the South East (excluding London) saw asking rents go down by 0.6 per cent.

The final region where asking rents fell was the West Midlands, which experienced a marginal drop of 0.1 per cent.

Renters in the North East were less fortunate, as asking rents in that region increased by 2.2 per cent over the period October to December 2024 – far more than any other area.

Over the last year, asking rents there have increased by 9 per cent – though it is still the cheapest area of the UK to rent a home at an average of £942 per calendar month.

On an annual basis, Londoners have had the smallest average rental increase at 2.4 per cent.

Rightmove’s property expert Colleen Babcock said: ‘Though this is the big picture of market activity, agents on the ground still tell us that the market is very hot, and some areas have improved more than others when it comes to the supply and demand balance.

‘Our own data shows that the average rental property is still receiving 10 applications per property, which is lower than the peak, but still double the pre-pandemic norm.’

SAVE MONEY, MAKE MONEY

£100 Isa cashback

£100 Isa cashback

Open a new stocks & shares Isa with £10k

Fix energy bills

Fix energy bills

Find out if you can save with our partner uSwitch

5.1% cash Isa

5.1% cash Isa

Get 5.10% with our TiM rate boost

5.01% cash Isa

5.01% cash Isa

Cash Isa and money management

Sipp cashback

Sipp cashback

Up to £3,000 when you open a Sipp by 31 Jan

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence. Terms and conditions apply on all offers.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.

Source link